MEDIOCRE

To improve the transportation network’s condition, ITRE finds that a minimum annual additional investment of $1.3 billion is needed to achieve “good” condition and $3.2 billion for “excellent condition.”

Outdated Funding Model

North Carolina currently relies on user fees to fund the state’s transportation system’s construction, maintenance, and operation. A user fee is paid by users of the transportation system through various methods. An example is a driver’s license or vehicle registration fee, the Highway Use Tax, or the “Gas Tax.”

IN FISCAL YEAR 2021-2022

NCDOT collected a total of $4.325 billion in state-based revenue – most of which was derived from user-based sources such as the state gas tax and vehicle registration fees. Specifically, the state collected:

Cars last longer meaning less Highway Use Tax.

There is not enough money invested in our system.

The “Gas Tax”

Gas tax revenues are NCDOT’s largest funding source, and the law requires these revenues be used only for transportation purposes.

Beginning in FY 2020-2021, an additional statutory change will increase maintenance funding by shifting the distribution of motor fuel tax proceeds.

Highway Fund:

Highway Trust Fund:

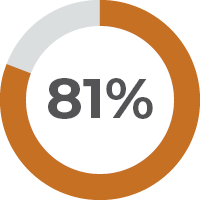

Gas Tax = Unreliable Revenue Source

Gas Tax revenues are North Carolina’s largest funding source for transportation infrastructure.

As cars become more fuel-efficient or carmakers transition to hybrid and electric vehicles, the Gas Tax will continue to become a more unreliable revenue source to fund our transportation needs.

Cell Phone > Transportation System

We pay more for a cell phone plan than we do to fund our transportation system, which is vital to our economic success.

Costly & Dangerous

Due to an influx of people moving here and a lack of investment and resources, our roads are deteriorating, unsafe, and congested, costing NC drivers $3.4 BILLION each year and too many lives.